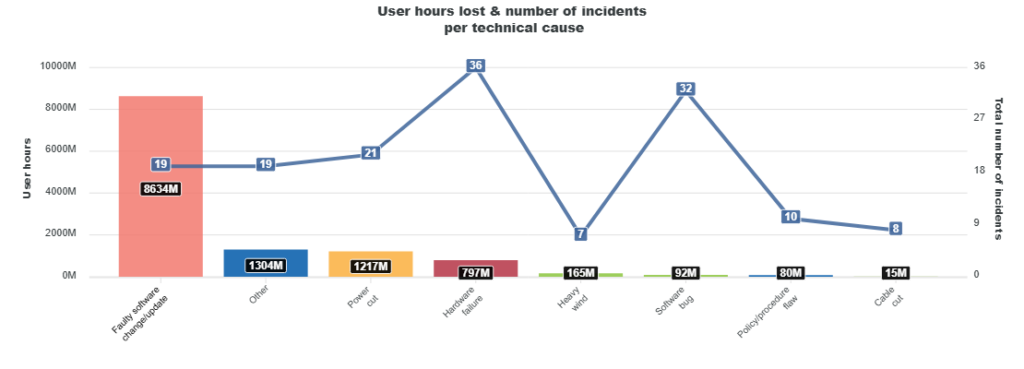

According to the European Union Agency for Cybersecurity (ENISA), telecommunications network users in the EU lost over 11 billion user hours in 2022 due to network incidents. With approximately 500 million unique subscribers in the EU (according to GSMA figures), this means that each subscriber lost, on average, more than 24 hours of network services during 2022.

This is a staggering number, especially when we consider the critical role telecom networks play in modern society. However, telecom networks are designed with stringent reliability and availability requirements, so what’s causing this massive loss of user hours?

Software Changes and Upgrades

When we dig deeper into the root causes of these 11 billion lost hours, it becomes clear that software changes and upgrades are a major factor. According to ENISA, only 12.5% of all telecom incidents are related to software changes or upgrades, yet these incidents are responsible for approximately 77% of the total lost user hours—around 6.8 billion hours. This is a clear example of the Pareto Principle in action, where a small subset of issues accounts for the majority of the impact.

ENISA defines software change/upgrade incidents as problems that arise during software configuration or installation, excluding software bugs, which are categorized separately.

The Cost of Telecom Incidents

What does this all mean in terms of cost? While various methods exist to estimate the financial impact of network incidents, a 2024 report from the Commission for Communications in Ireland (ComReg) offers an interesting perspective. Instead of measuring the direct financial losses from outages, ComReg surveyed consumers to find out how much they would be willing to pay extra to avoid these disruptions. The survey revealed that consumers would pay an average of €6.50 extra per year to ensure a reliable service without interruptions.

Extrapolating this figure across the EU, we find a potential market of €3.2 billion. This market opportunity is based on the assumption that consumers across the EU would be willing to pay a similar amount to avoid telecom incidents. For context, the total telecom market in the EU is valued at around €500 billion.

A Clear Business Case

The numbers are compelling. Telecom operators could tap into a €3.2 billion market by improving network availability. More specifically, 77% of this potential could be realized by addressing incidents related to software installation and configuration.

Next Steps for Telecom Operators

What can telecom operators do to unlock this potential? In my next post, I’ll dive into potential solutions for improving network reliability and reducing downtime caused by software-related issues.

References

- ENISA 2022 Telecom Incident Report: https://www.enisa.europa.eu/publications/telecom-security-incidents-2022

- ENISA Incident reporting per legislation: https://ciras.enisa.europa.eu/ciras-visual

- The Economic and Societal Impacts of Network Incidents report (2023) by the The Commission for Communications Regulation (ComReq): https://www.dotecon.com/wp-content/uploads/2023/08/ComReg-2359a.pdf

- GSMA The Mobile Economy Europe 2023 report. https://www.gsma.com/solutions-and-impact/connectivity-for-good/mobile-economy/wp-content/uploads/2023/11/GSMA-Mobile-Economy-Europe-2023.pdf